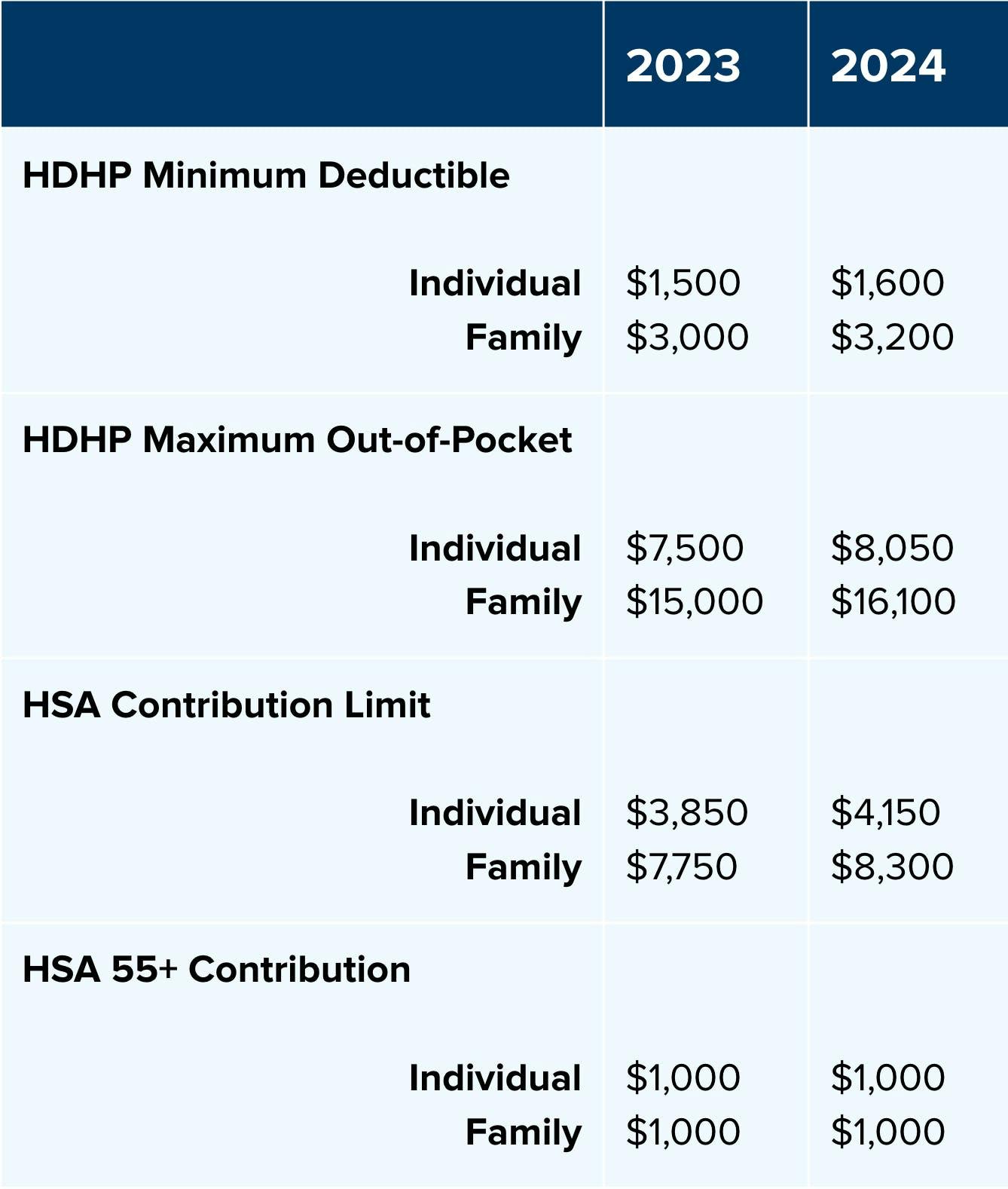

Fsa Eligible Expenses 2024 Irs List – Each contributor must have their own Federal Student Aid (FSA tax information from the prior-prior year. For example, the 2024-2025 FAFSA will request tax information from the 2022 tax year. . Annual contribution limits $4,150 for self-only coverage in 2024 eligible for an HSA, and your employer does offer an FSA, it may be your best option for paying for healthcare expenses with .

Fsa Eligible Expenses 2024 Irs List

Source : www.fool.comFlexible Spending

Source : www.trinity-health.orgHSA Eligible Expenses in 2023 and 2024 that Qualify for

Source : www.fool.comBright Wood Corporation on LinkedIn: The enrollment deadline for

Source : www.linkedin.comBright Wood Corporation | Madras OR

Source : www.facebook.com24 Coolest Wellness & Gadget FSA Finds / HSA Items in 2024; From a

Source : www.thebossysauce.comFSA Archives Admin America

Source : adminamerica.com2024 FSA Eligible Items & Where To Buy | MetLife

Source : www.metlife.comSignificant HSA Contribution Limit Increase for 2024

Source : www.newfront.comIRS Updates FSA Amounts for 2024 CPA Practice Advisor

Source : www.cpapracticeadvisor.comFsa Eligible Expenses 2024 Irs List HSA Eligible Expenses in 2023 and 2024 that Qualify for : To come up with this list of the to an HSA in 2024 is $4,150 for individuals and $8,300 for families. HSA funds used for qualified medical expenses can be withdrawn tax-free. . 2024 tax season officially detailed updates,” including if the IRS is requesting more information. —Any eligible deduction, such as educational expenses, medical bills, charitable donations .

]]>